Negative covered bond yields

Since May 2015 Nykredit has offered mortgage loans funded by variable-rate bonds the coupons of which may turn negative. Variable-rate bond coupons turned negative for the first time at the interest rate fixing on 1 July 2015. Bullet covered bonds are traded at a premium resulting in a negative yield-to-maturity for borrowers and investors. Nykredit has adjusted its procedures in relation to bonds to allow for negative interest. The following models are used to handle negative interest:

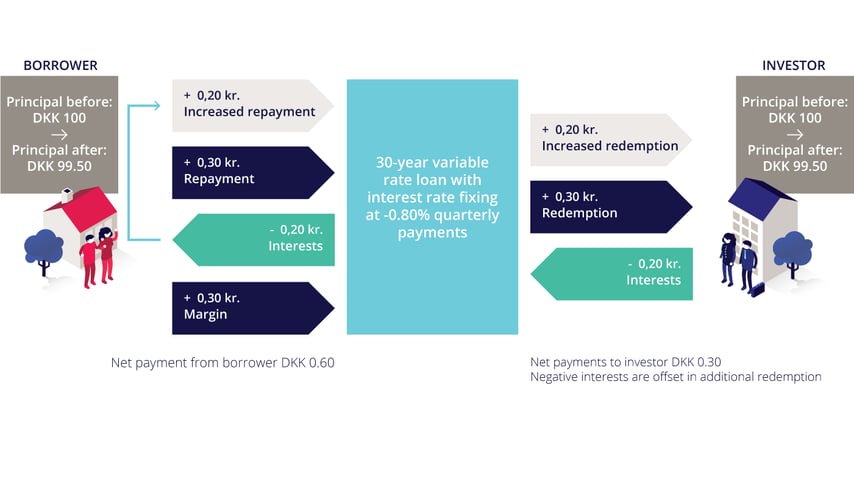

The principal payment model, under which borrowers are compensated for the negative interest by way of an extraordinary principal payment on the loan. As a result, the debt outstanding on the loan will be reduced faster than in a scenario with positive interest rates. On the investor side, negative interest is handled by reducing the bond principal by the redemptions related to the ordinary principal payments on the loan plus the extraordinary principal payment.

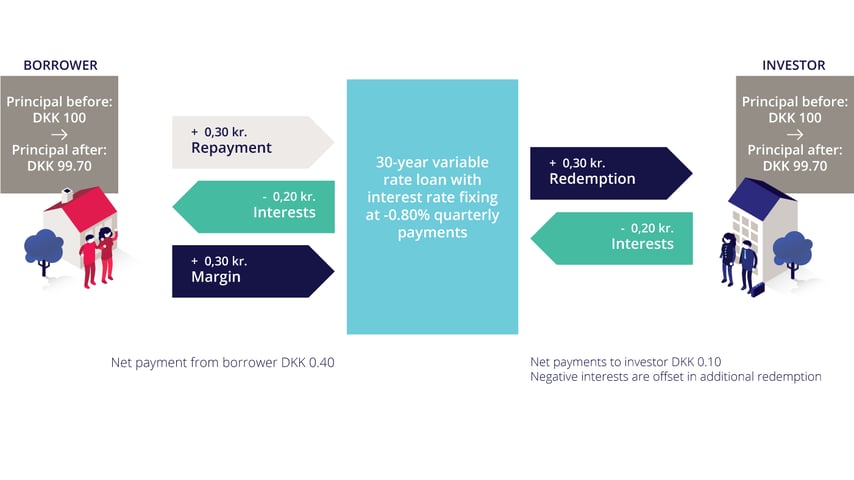

The cash model, under which the negative interest is paid out to borrowers. Bond investors will have their bond principals reduced by an amount corresponding to the negative interest. Settlement with borrowers will be in the form of a set-off against borrowers' mortgage payments, provided the negative interest does not exceed the mortgage payment amount. If the negative interest exceeds ordinary principal payments, the mortgage bank will issue bonds of a market value corresponding to the negative interest payment to the borrower and transfer the proceeds to the borrower.