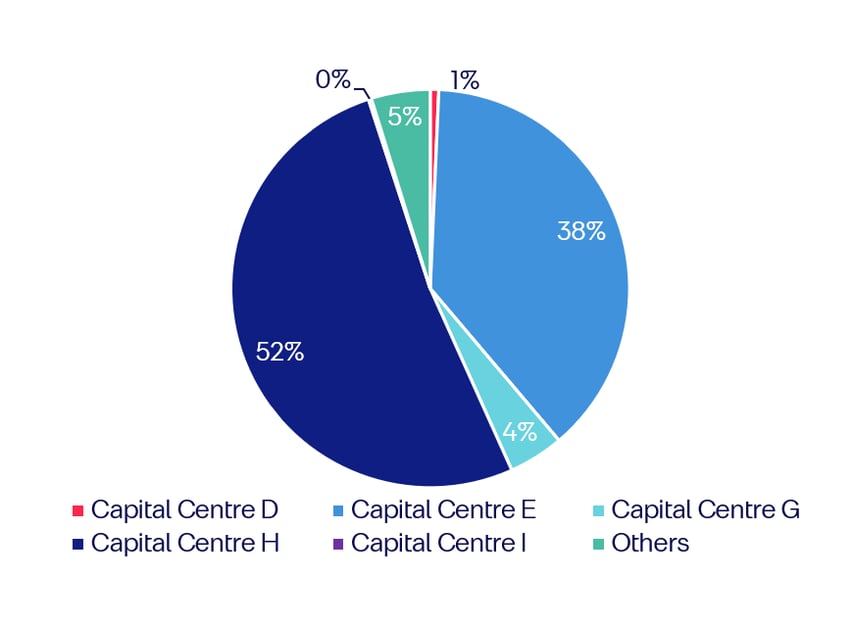

Capital centre D

A RO capital centre. No new loans are issued from this capital centre, and the mortgage loans in the capital centre may be refinanced into loans in other capital centres or will run off.

Capital centre E

An SDO capital centre. Most of the mortgage loans in Capital Centre E carry a fixed interest rate. All loans have a term of 10 to 30 years and are match-funded throughout the loan term.

Capital centre G

The covered bonds (ROs) in Capital Centre G carry a variable interest rate and are subject to refinancing. Most of the loans have terms that are longer than the maturities of the underlying covered bonds. The bonds must therefore be issued with a maturity extension option (soft bullets).

The bonds are issued to fund loans for commercial properties, agricultural properties etc. Until 2014 bonds from Capital Centre G were also used to fund residential mortgage loans.

Capital centre H

An SDO capital centre. The mortgage loans of Capital Centre H carry a variable interest rate and are subject to refinancing. Most of the loans have terms that are longer than the maturities of the underlying covered bonds. The bonds must therefore be issued with a maturity extension option (soft bullets).

Customers bear the refinancing risk.

Capital centre I

The covered bonds (ROs) in Capital Centre I carry a fixed interest rate. All loans have a term of 20 to 30 years and are match-funded throughout the loan term. Until 2014 bonds in Capital Centre I were also used to fund residential mortgage loans.

Capital centre J

An SDO capital centre from which 1-10-year bullet covered bonds are issued to fund public housing loans.

The loans and bonds are government-guaranteed. The bonds are currently all sold to Danmarks Nationalbank.